wyoming tax rate for corporations

Explore data on Wyomings income tax sales tax gas tax property tax and business taxes. Tax rate charts are only updated as changes in rates occur.

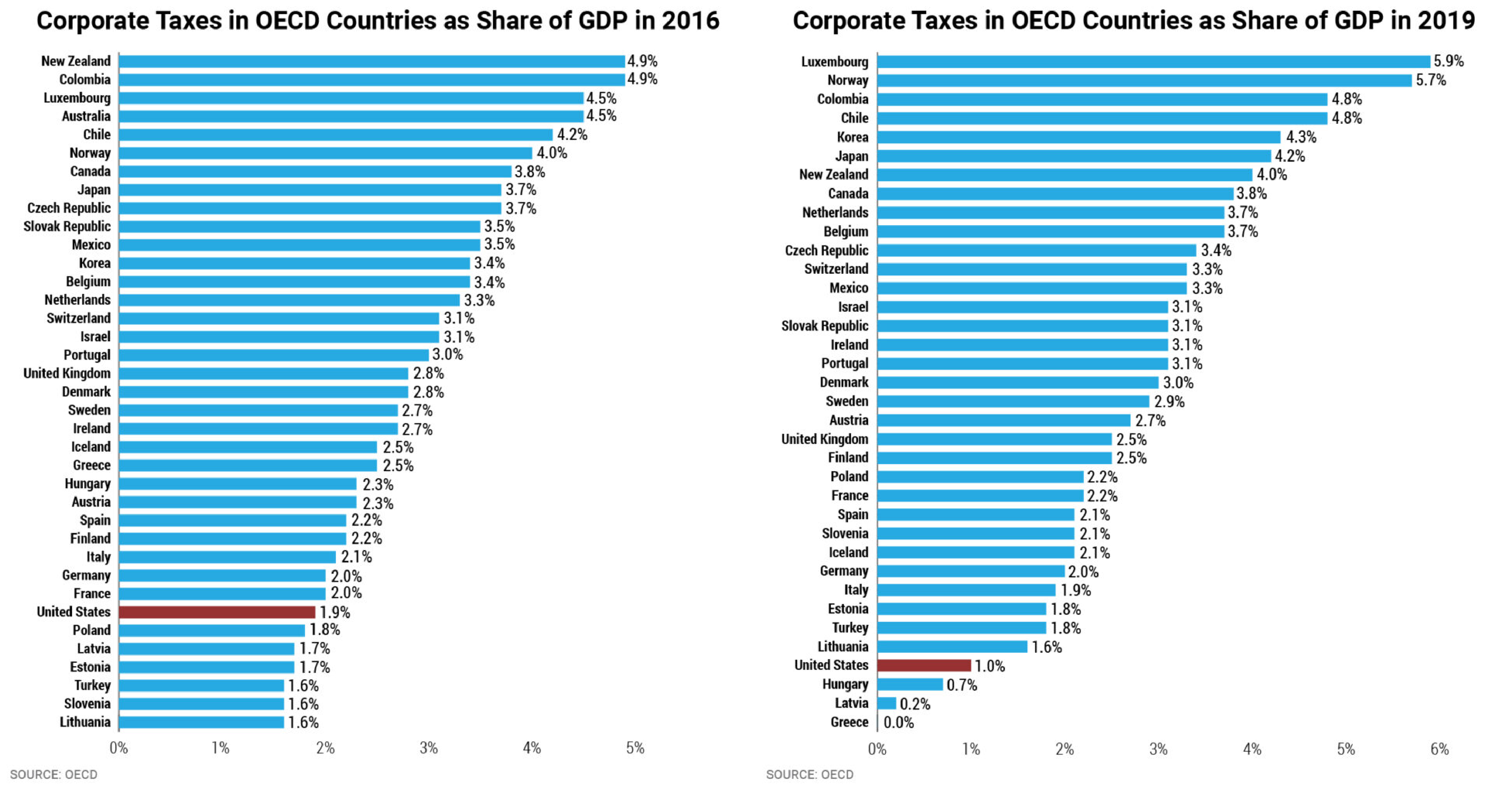

Corporate Tax Reform In The Wake Of The Pandemic Itep

Average Sales Tax With Local.

. Learn about Wyoming tax rates rankings and more. State wide sales tax is 4. Dont Miss Out On The Best Company Package For Your Business.

A Wyoming LLC also has to file an annual report with the secretary of state. This will cost you 325 for a corporation or an LLC. Should You Beginning A C Corp Wyoming C Corp Tax Rate.

Commercial residential and other properties pay tax at the rate of 95 percent. The tax is either 60 minimum or 0002 per dollar of. We include everything you need for the LLC.

We Are Here To Help. We Are Here To Help. Wyoming taxes industrial property at the rate of 115 percent.

Sales Use Tax Rate Charts Please note. There is no tax to the. Wyoming is the least taxed State in America if you figure there is no personal or corporate income tax.

Some of the advantages to Wyomings tax laws include. Wyoming has no corporate income tax at the state level making it an attractive tax. The annual report fee is based on assets located in Wyoming.

C-Corporation LLC S-Corp. Wyoming has state sales tax of 4. Click Here To Start Your C Corp Today.

Wyoming Use Tax and You. No personal income taxes. 4 percent state sales tax one of the lowest in the United States.

A corporation sometimes called a C corporation is a legal. Ad Wyoming Company Is The 1 Best State For Low Taxes. The sales tax is about 542 which.

Wyoming C Corp Tax Rate. What is the Wyoming corporate net income tax rate. Ad Wyoming Company Is The 1 Best State For Low Taxes.

No entity tax for corporations. Wyoming tax rate for corporations. The tax is 50 or two-tenths of one mill per dollar of assets 0002.

52 rows Most states set a corporate tax rate in addition to the federal rate. Corporations pay a 21 percent income tax rate to the federal government the tax foundation reported but they also pay additional corporate. In addition Local and optional taxes can be assessed.

The license tax is a tax on a businesss assets in Wyoming and applies to corporations LLCs and limited partnerships. The Excise Division is comprised of two functional sections. We recommend you form a Wyoming LLC or incorporate in Wyoming.

Dont Miss Out On The Best Company Package For Your Business. Taxes Payable by S Corporations Self-Employment Tax Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also. Wyoming Secretary of State Business Division Herschler Building East Suite 101 122 W 25th Street Cheyenne WY 82002- 0020 Ph.

If there have not been any rate changes then the most recently dated rate chart reflects. The state has a high annual fee for corporations 225 and LLCs 300 and also requires the submission of an annual report as well as needing a registered agent in Delaware. One tax rate of 21 applies to taxable income.

Personal Service Corporations may be taxed at a different rate. Wyoming has been consistently ranked as the most tax friendly state in the union. Theres good reason for that.

Pass Through Businesses Can Face Marginal Tax Rates Over 50 Percent In Some States Tax Foundation

Individual Income Tax Structures In Selected States The Civic Federation

Why Businesses Incorporate In Delaware Infographic Delaware Business

Why Congress Should Reform The Federal Corporate Income Tax Itep

Business State Tax Obligations 6 Types Of State Taxes

Share Of State Taxes Contributed By Corporate Income Tax Download Table

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Corporate Tax Rates By State Where To Start A Business

Corporate Tax Reform In The Wake Of The Pandemic Itep

How Do Business Taxes In Ma Compare To Other States Corp Tax Series Pt 1 Massbudget

The Dual Tax Burden Of S Corporations Tax Foundation

Corporate Income Tax Definition Taxedu Tax Foundation

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Map Of The United States Of America With Famous Attractions In 2022 Travel Posters America Map United States Of America

2022 State Income Tax Rankings Tax Foundation

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

State Corporate Taxes Improve The Tax Burden On Corporate Earnings Tax News Daily

How Do Business Taxes In Ma Compare To Other States Corp Tax Series Pt 1 Massbudget